Think about bundling or negotiating your internet, phone, and cable bills with providers. Additionally, Experian Boost allows you to enhance your credit score by adding qualified bill payments to your credit report.

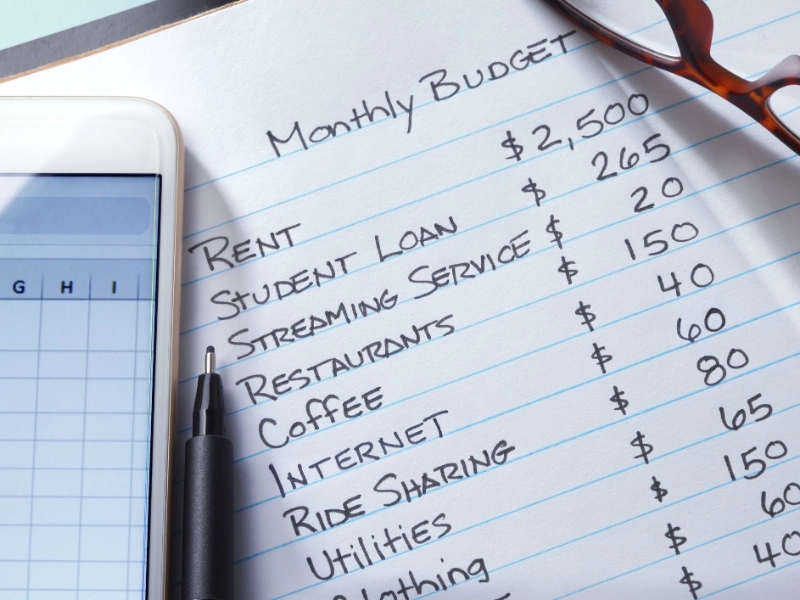

1. Establish a spending plan.

It goes without saying that creating a budget can reduce your expenses. Although certain individuals might encounter difficulties adhering to rigorous, category-based budgeting techniques, alternative approaches exist for creating a budget that accommodates debt repayment and savings objectives.

Begin by enumerating your basic spending, which includes utilities, cell phone service, and rent or mortgage payments. Next, ascertain which of your monthly expenses are variable (they vary from month to month) or fixed (they remain the same each month). Next, calculate your monthly budget for each of these areas. Using previous bank and credit statements, maintaining a spending diary, or retaining receipts can all help achieve this. Keep track of your expenditures to make sure you are adhering to your monthly spending plan.

2. Compare prices

Comparing prices a little bit might have a large impact. For instance, comparing prices on cable and home internet might help you locate a better bundle than if you just used one service. In a similar vein, changing power providers can result in cheaper energy costs.

Using a price comparison website or app is another way to shop around for anything from your phone and broadband to your auto insurance. Finally, you can lower your electricity bills by going paperless with your billing and sending in regular metre readings.

By choosing store-brand items over name-brand ones, such as cereal and toilet paper, you can also make quick savings. Thrift stores and used-goods purchases both contribute to waste reduction and cost savings.

3. Establish AutoPay.

Even though automatic payments might simplify budgeting, it's crucial to monitor spending and keep an eye on your account balances to prevent incurring expensive overdraft penalties. In order to assist you in monitoring your spending patterns, several banking applications even have automatic savings options.

By allowing a business to automatically charge your debit or credit card on a monthly basis, you can automate recurring bills. Generally, you may set up autopay by logging in, choosing the biller, inputting their account number, and choosing which account to use for the payment on your bank's online or mobile banking platform.

Shah emphasises how crucial it is to check your internet or wireless bill to make sure you're not overpaying. Since there is no set price for broadband and providers are free to change their rates at any moment, it makes financial sense to look for monthly deals.

4. Change the utilities.

Consider moving to a fixed pricing plan if your summertime electricity bills increase dramatically. In the event that usage is low, this could potentially help you save money each month.

If you want to save money on electricity, think about installing a smart thermostat. It can recognise the routines of your household and make adjustments on its own when utility usage is at its highest.

To conserve electricity, water, and time, wash dishes in the dishwasher rather than by hand. Invest in a smart plug as well, which will switch off your appliances when you leave the house or at night.

Make sure you're getting the greatest discounts by evaluating your security monitoring, internet, and cable providers. For instance, you may be able to save money by combining services or removing unused gear or channels. If you're not happy with your service provider, give them a call to find out about any current specials or introductory deals.

5. Credit Card Management

Credit cards can reward you and help you establish a good credit score, but they can also easily become excessive. To avoid accruing interest, make it a habit to pay off your credit card debt each month.

If you follow a weekly or monthly budget, think about designating a day to add up all of your purchases and credit card statements on a weekly basis to make sure you're adhering to your spending caps. This process is made easier by the spending breakdown capabilities that many cards offer.

Think carefully about the kinds of purchases you're making with your credit card as well. It could be time to switch cards if you frequently spend in areas that don't pay off. You'll maximise your benefits and save money by doing this.

Advertisement

Recommended Reading: How Many Calories Does Rock Climbing Burn in 30 Minutes?

De-duplicates conceptual noise.